This chapter contains the following topic:

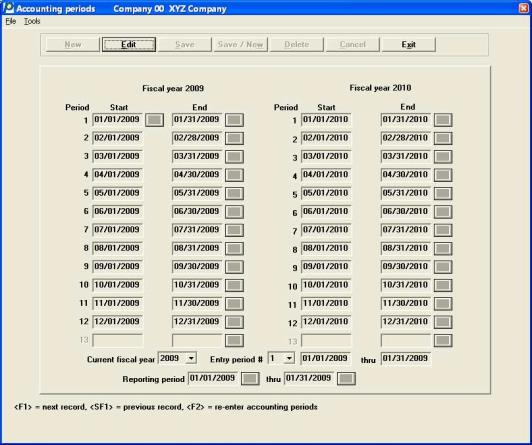

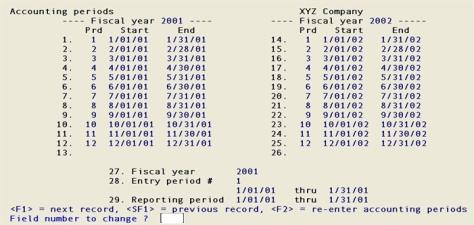

The Accounting Periods selection is used to enter the accounting periods for two fiscal years: the current fiscal year and the following fiscal year. You may define up to thirteen accounting periods for each year. Most companies use twelve periods, but more or fewer periods sometimes occur; especially in the transition year following a change to the fiscal year-end.

You also provide the entry and reporting periods on this screen.

Select

Accounting periods from the Master information menu.

A screen similar to the following appears:

Menu Selections

Menu selections are available starting at the top left of the screen. Most of these are the same from screen to screen. If a menu selection is grayed out you will not be able to access it.

In character mode the following screen appears:

From this screen you can work with both new and existing entries.

There is one entry for each year you have done business.

|

Note |

Prior to PBS 11.7 only one 2-year combination existed in periods. Now you may retain periods from older years. |

If you are entering accounting periods for the first time, PBS will create the accounting periods based on the Current fiscal year field in G/L Control Information.

The left side fields #1-13 constitute a table of accounting periods for the current fiscal year, and the right side fields #1-13 a table for the next year. The initial default is that the current fiscal year corresponds to the current calendar year, that the periods correspond to calendar months, and that there are twelve periods in a year.

The Fiscal year field similarly defaults to the current calendar year, and Entry period # and Reporting period # to the current month.

If you want to use the examples in this documentation select <F2> to Re-enter accounting periods and then enter examples as shown for each field.

|

Note |

In almost all cases only re-enter accounting periods on a test or demo system. Never re-enter the accounting periods on a live system unless you have a special exception. One possible exception is you want to change your year from a non-calendar fiscal year-end to a calendar fiscal year-end. |

Enter the following information:

Enter the starting date and ending date for Period 1 of the current fiscal year.

|

Format |

MMDDYY for each field |

|

Example |

Type 10115 for the start date Press <Enter> for the end date |

2-13 Ending date

Options

Enter the ending date for a period in the current fiscal year, or use the option:

|

<F1> |

To delete this period and all subsequent periods in the current fiscal year |

|

Format |

MMDDYY for each field |

|

Example |

Press <Enter> at each field, except select check <F1> for period 12 to indicate it is the last period |

Enter the starting date and ending date for Period 1 of the following fiscal year.

|

Format |

MMDDYY for each field |

|

Example |

Press <Enter> |

2-13 Ending date

Options

Enter the ending date for a period in the following fiscal year, or use the option:

|

<F1> |

To delete this period and all subsequent periods in the current fiscal year |

|

Format |

MMDDYY for each field |

|

Example |

Press <Enter> at each field, except select the check box period 12 to indicate it is the last period |

Normally, this is set to be the current fiscal year. However, at the start of every fiscal year you will have to process transactions in the new year before the old year has closed. During this time this field is set to the new fiscal year. Entries can then be made in the following year, and the Trial Balance report, Working Trial Balance, and financial statements (Financial Statements) can be run for the following year. Refer to the Close a Fiscal Year chapter for further information.

Enter either the current fiscal year (shown on the left-hand side of the screen) or the following fiscal year (shown on the right-hand side of the screen).

|

Format |

9999 |

|

Example |

Type 2015 |

|

Note |

When setting up G/L for the first time, if you are using a non-calendar fiscal year, it is recommended that the starting fiscal year be the earlier of the two years. This will become helpful later if you ever switch to a calendar year. |

(This field must be re-entered whenever the fiscal year is changed.)

This field is set to be the period for which you wish to make entries using General Journal. The software then warns you if an entry is dated outside of the current period.

The software displays this period in many places, namely in selections which process entries such as General Journal, Standard Journal, Get Distributions (the interface to other modules), and Summarize General Ledger (the data compression feature).

Enter a number (1-13) corresponding to one of the accounting periods defined. Once you have entered the period number, the dates for the period are displayed.

Options

You have the following option:

|

<F4> |

To access the calendar lookup on each field |

|

Format |

99 |

|

Example |

Type 3 |

(This field must be re-entered whenever the fiscal year is changed.)

This field is used to specify the time period to be used as the current period on the Trial Balance report and all financial statements. For the Working Trial Balance, the ending date of the reporting period is used for the Balance as of date.

The software displays this period in many places, namely in selections which print reports or display account balances. Selections where the reporting period is shown include Trial Balance, Working Trial Balance, Source Cross Reference, View Accounts, and Correcting Entries.

Because this field is entered separately from the current period, you may make entries for one period while printing reports for a different period.

This is especially useful in network environments or other multi-user situations, since you can continue normal entry processing associated with the current period while special reports are prepared for a different period (the reporting period).

The reporting period defaults to the entry period when the accounting periods are created, but you can change this.

The dates here are used as a default when you print the Trial Balance report. However you may override the these dates and the dates can be from any year, even outside the entered fiscal year.

|

Note |

If the reporting period corresponds to one or more accounting periods within the year specified by the Fiscal year field, the Working Trial Balance report, and financial statements are processed more efficiently. You may use any date range that you want and the software still produces accurate reports; however, unless this flexibility is required by your company, we recommend entering a reporting period which corresponds to one or more accounting periods. |

|

Format |

MMDDYY for each field |

|

Example |

Type 10115 for the starting date. Type 33115 for the ending date |

If you selected <F2>, the cursor goes to the first ending date field and the cursor will move though the fields in sequence.

| • | The starting date is entered only for the first period of the first year. For all other periods it automatically defaults to the day after the ending date of the previous period, and cannot be changed. |

| • | If the starting date of a period is the first day of the month, the ending date defaults to the last day of that month. Otherwise there is no default. In either case, you may enter whatever ending date is correct for your period. |

Options

| • | To enter fewer than thirteen periods in a fiscal year, use the option: |

|

<F1> or <Space bar> |

To make the current period the last one of this fiscal year |

| • | You will be warned if you have more or fewer than twelve periods in a year, or if the fiscal year is not a full year long. |

If you answer N to Do you wish to re-enter periods?, change any field as desired; or use the option:

|

<F1> |

To change the unnumbered fiscal year fields in the headings |

When changing period fields individually, the cursor moves only to the ending date of the period (except for the first period of the first year, when both dates must be entered). You cannot change a single period in isolation; you must continue to enter period-end dates until you have entered a period whose ending date is the day before the next period’s starting date.

You may need to add periods to your current fiscal year. One example is to go from a 12 period year to a 13 period year.

In either Graphical or Character mode you should re-enter all the periods in order to retain the existing starting and ending dates for the current fiscal year.

|

<F2> |

To add another period to the year in Graphical mode. It is only available, when editing the periods and when the cursor is on the End date for the last period of either year |

In Character mode you must re-enter all the periods if you want to add more periods.